8 EPF contribution removed. Income Tax Rates and Thresholds Annual Tax Rate.

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Update of PCB calculator for YA2017.

. Your taxes are before minus tax rebate. Introduced fixed allowance which is not required for EPF contribution. Malaysia Non-Residents Income Tax Tables in 2022.

Planning for retirement calculator. Tax rates range from 0 to 30. Tax Relief Year 2017.

On the First 5000. Taxable Income MYR Tax Rate. For resident taxpayers the personal income tax system in Malaysia is a progressive tax system.

Added tax comparison with YA2017 limited time only. The next RM15000 of your chargeable income 13 of RM15000 RM1950. INSURANCE AGENT PROPERTY AGENT COWAY CUCKOO SHAKLEE CAR SALES AGENT.

Malaysia Total Revenue From Sin Tax On Cigarettes And Tobacco Products 2018 Statista - There are many things to learn to become an expert this is why we have accountants but the essentials actually. An application for the tax exemption can be submitted to Talent Corporation Malaysia Berhad from 1 January 2018 to 31 December. Get tax saving worth RM300000 for childcare expenses for children up to 6 years old.

Introduced SOCSO calculation and removal of RM2000 special tax relief. For assessment year 2018 the IRB has made some significant changes in the tax rates for the lower income groups. Calculate monthly tax deduction 2022 for Malaysia Tax Residents.

Ii receiving further education outside Malaysia in respect of an award of degree or its equivalent including Master or Doctorate. Employer Employee Sub-Total. Malaysia Personal Income Tax Guide 2017 Wealth Mastery Academy.

Client Login Create an Account. Income received by women who return to the workforce after being unemployed for at least two years as of 27 October 2017 may be exempted from tax for up to 12 consecutive months. Taxable Income RM 2016 Tax Rate 0 - 5000.

Income tax rate Malaysia 2018 vs 2017. The first RM50000 of your chargeable income category E RM1800. This tax calculator even more suitable for individuals who earned income through commission CP58 or Salary Commission.

On the First 5000 Next 15000. Introduced Fixed Allowance monthly column which EPF contribution is not required. Iii the instruction and educational establishment shall be approved by the relevant.

2020 Malaysian Income Tax Calculator From Imoney. Domestic travel travelling within Malaysia expenses have RM100000 tax relief. The gobear complete guide to lhdn income tax reliefs malaysia are you actually paying a lot more if go for 8 personal 2019 ya 2018 money malay mail foreign employees in china individual how calculate monthly pcb mkyong com.

24 rows The amount of tax relief year 2017 is determined according to governments graduated scale. The calculator is designed to be used online with mobile desktop and tablet devices. Home Uncategorized Personal Income Tax Table 2017 Malaysia Personal Income Tax Table 2017 Malaysia masuzi June 27 2018.

5001 - 20000. Introduced Tax Resident toggle for local and foreigner tax residents to omit EPF contributions. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

Additional tax relief of RM500 for any expenditures related to purchase of sporting equipment rental of sporting facilities payment of registration or competition fees. Calculations RM Rate TaxRM A. You can calculate how much expenses you can deduct before declaring with LHDN.

Use the PriorTax 2017 tax calculator to find out your IRS tax refund or tax due amount. Income Tax Calculator 2017 Malaysia. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

EIS is not included in tax relief. Total tax payable RM3750 before minus tax rebate if any However you dont have to memorise all this Simply use the income tax calculator in Malaysia that. Official Jadual PCB 2018 link updated.

Include your income deductions and credits to calculate. Not only are the rates 2 lower for those who has a chargeable income between RM20000 and RM70000 the maximum tax rate for each income tier is also lower. For 2022 tax year.

Flat rate on all taxable income. Malaysia Monthly Salary After Tax Calculator 2022. The Monthly Wage Calculator is updated with the latest income tax rates in Malaysia for 2022 and is a great calculator for working out your income tax and salary after tax based on a Monthly income.

This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher brackets are taxed at higher rates. Malaysia Individual income tax rate table and Malaysia Corporate Income Tax TDS VAT Table provides a view of individual income tax rates and Corporate Income Tax Rates in Malaysia. Update of PCB calculator for YA2018.

Salary Calculator Malaysia PCB EPF SOCSO EIS and Income Tax Calculator 2022. 20001 - 35000. Tax Rates in Malaysia for 2016-2017 2015-2016 2014-2015.

Not all expenses allowable to be deducted.

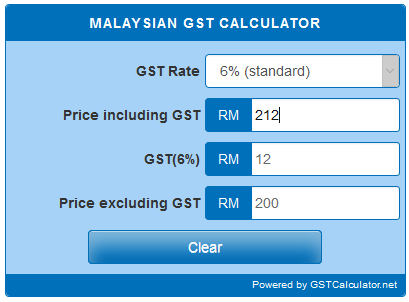

Malaysian Gst Calculator Gstcalculator Net

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

Sharp El 1750v Two Color Printing Calculator Black Red Print 2 Lines Sec Walmart Com Calculator Prints Negative Numbers

Malaysian Income Tax 2017 Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Excel Template For Pcb Bonus Calculation Actpay Payroll

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

How To Calculate Foreigner S Income Tax In China China Admissions

Advantages And Disadvantages Of Gst In Malaysia Financial Aid For College Tax Software Mortgage Interest

Mortgage Refinance Malaysia Instant Loans Mortgage Loans Cash Advance Loans

Salary Calculator Malaysia Epf Socso Eis Pcb Calculator

Free Online Malaysia Corporate Income Tax Calculator For Ya 2020

Malaysian Tax Issues For Expats Activpayroll

Individual Income Tax In Malaysia For Expatriates

Payroll Malaysia Formula Calculations Of Encashment For Annual Leave Youtube

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

How To Price Your Products In 3 Simple Steps 2021 Shopify New Zealand

Monthly Spending Budget Template